Archives

- October 2020

- February 2019

- January 2019

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- November 2017

- October 2017

- July 2017

- February 2017

- November 2016

- October 2016

- September 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

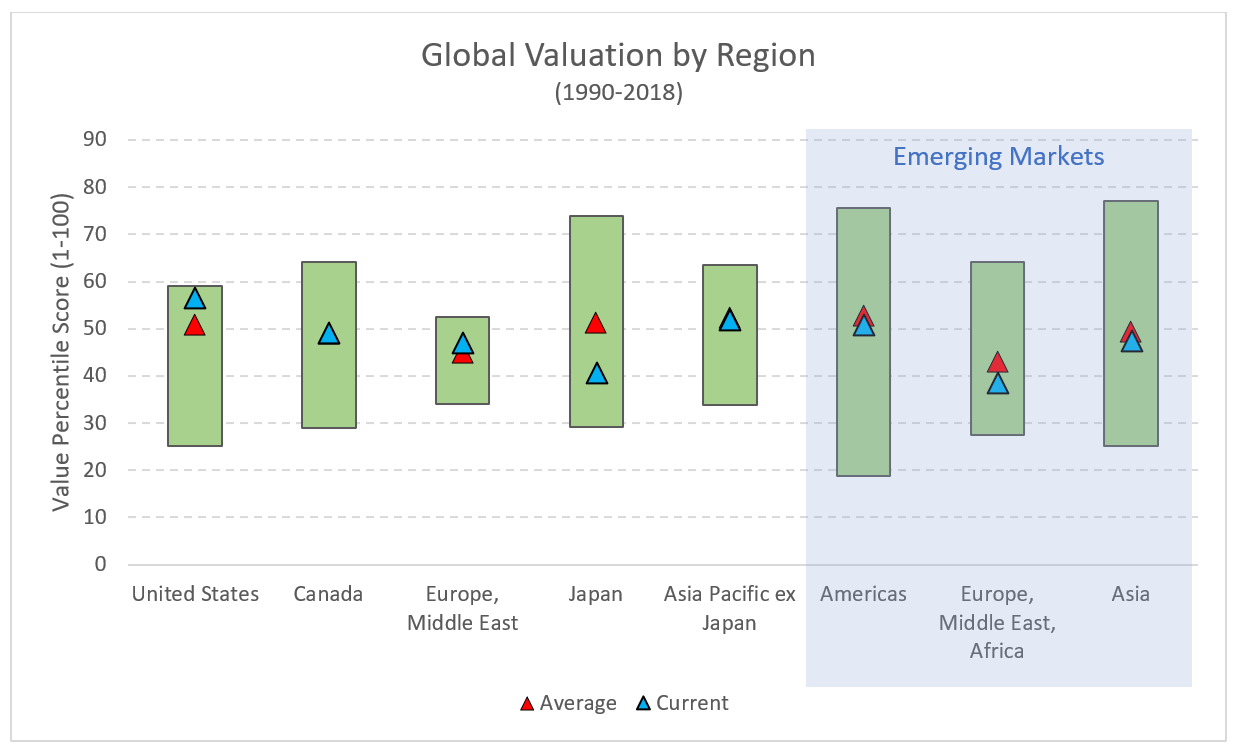

Values woes, profitability, debt trends, and a possible catalyst in value’s favor.