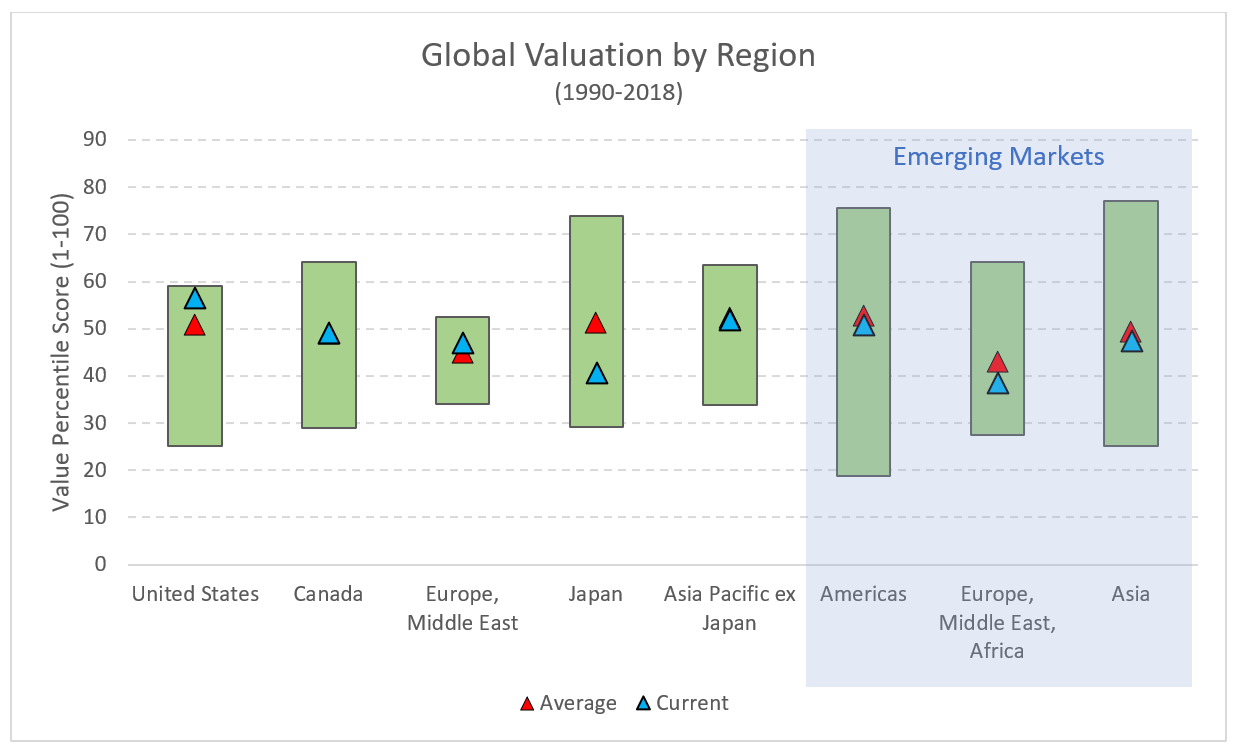

Investors always want to know what’s cheap—cheap relative to the opportunity set and relative to history.So it’s always interesting to take a look at the global landscape to see which markets are trading at attractive prices.

Coaches teach us the fundamentals of some activity. If there was an “ideal” investment coach, what fundamentals would she focus on? This is my current take.

There is some popular marketing spin going around that indexing—constructing portfolios based on market-cap weights—is effective because it allows an investor to own more of companies that have been successful and appreciated, while moving away from losers that have been unsuccessful and declined This sounds logical, but it is empirically wrong.

What are the levers that managers can pull to drive return for any investment strategy? This piece boils it down to consistency, magnitude, and conviction, and finds that even the best managers have done a poor job at portfolio construction. Most would be better off equal-weighting their own portfolios.

The first of many hopefully...my good friend Steven Wood and I have been tossing around the idea of collaborating on some work in hopes it ups both of our research games. I often get asked whether or not factors go out of favor. This is a pretty good case study that yes, sometimes what worked in the past doesn't continue in the future.

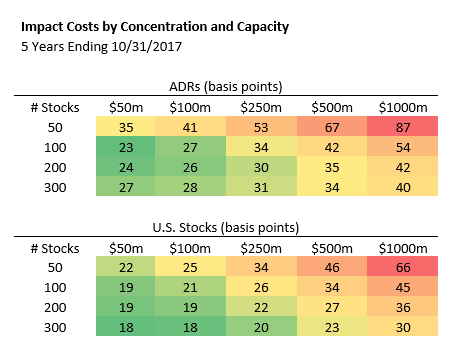

There are a hundred ways to evaluate whether an investment is cheap--discounted cash flows, competitor multiples, mean reversion, multiple of projected earnings--the list goes on...and on. What's cheap now form a factor perspective?

One of the things I’ve learned over the years is that there is a persistent dualism in conducting research balance—a between reliable preexisting findings and questioning preconceived notions.

Anyone overweight to non-U.S. allocations has suffered over the previous ten years. The current equity bull market has not been kind to non-U.S. allocations. At a recent conference I attended, the term ‘TINA: there is no alternative’ came up more than once in the context of allocating investor portfolios. It captures the collective sentiment that equities, despite a massive bull run and rising valuations, are one of few viable asset classes to park capital.

Stock markets are the greatest compounders of wealth the world has ever seen. Sadly, most introductory investment courses and literature do not begin with an explanation as to why markets go up. It’s such a fundamental question, but it is often overlooked.