3 reasons the macro environment makes U.S. small cap very interesting

Management of large U.S. firms decided long ago to outsource the growth of their sales, earnings and cash flows to foreign markets. Last year, nearly half of S&P 500 revenues came from overseas. The portion of S&P 500 profits from foreign sources has been growing at twice the rate of profits from domestic sources since 2000. Multi-nationals currently have a few trends working against them that make small cap stocks interesting.

First, the massive appreciation of the U.S. dollar over the last year will slowly chip away at the earnings for large firms in the coming quarters. As I have written previously, the 23.3% strengthening of the dollar is almost unprecedented historically. Small stocks typically have domestic-oriented businesses that are not directly impacted by currency fluctuations.

Second, from a longer term perspective, large multi-national firms are now in the unenviable position of needing to find new sources for earnings growth on a massive scale. Think, for example, of Wal-Mart. The company generates $485 billion per year in sales. To increase sales over the next year in-line with the recent 3.7% GDP print, the company would need to generate new revenues of almost $18 billion per year!

In some cases, large companies have capitulated, instead preferring to repurchase their own stock as opposed to growing the business organically. This can occur when companies struggle to find new opportunities for expansion. My colleague, Patrick O'Shaughnessy, noted in a recent piece that as of 6/30/2015 nearly half a trillion dollars was spent on corporate buybacks over the trailing twelve months. He finds though that the majority of buyback programs are small relative to company size–typically a sign of low management conviction in the program. Because small cap companies are attempting to grow their revenues and earnings from a much smaller base, they can engage in lucrative projects that would not meet the requirements for scale of large firms.

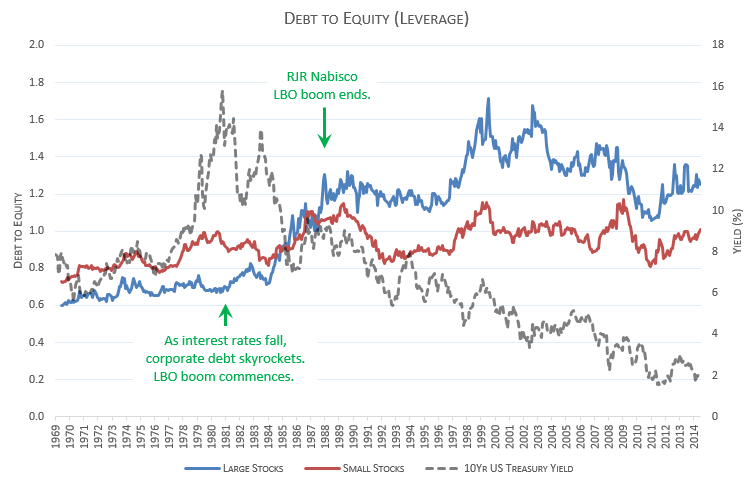

Third, low interest rates have boosted current profit margins of large companies to levels not seen since the 1960’s. As the Fed tightens monetary policy, look for the profit margins of debt dependent companies to shrink. QE benefited large cap companies by lowering the cost of debt for the strongest players. QE is really just the apex of a multi-decade debt binge that began with the infamous leveraged buy-out (LBO) boom in the 1980’s–the RJR Nabisco deal being one of the most notorious. Since the mid 1980’s, large companies have used a much larger portion of debt in their capital structures. Today, the small cap market is about 20% less levered with a debt to equity ratio of about 1.0.

Small cap firms, because of their risk profiles, do not have ready access to secondary debt capital markets. Their debt issues would be too small and too risky. So, they are forced to access financing through stock issuance and bank loans. Given post crisis bank capital requirements, banks have been less willing to lend. With QE over in the U.S., large firms struggling to find avenues for global growth, and the prospects of increased interest rates, small cap firms appear to be relatively well positioned in the coming years. In future posts, I will talk about some characteristics of small cap stocks that historically lead to outperformance.

Data notes: Small cap stocks are those stocks traded on U.S. exchanges with an inflation adjusted market capitalization between $200 million and $2 billion.